Having auto insurance helps you feel a little bit safer behind the wheel. Although it can’t prevent accidents from happening, insurance coverage can help you pay for medical bills and property losses that result from your accident. But what happens if you get in an accident with a driver who is uninsured? Will your insurance still cover you? Do you have to file a special claim in order to obtain compensation for your injuries?

This guide covers what to do after getting in an accident with an uninsured driver in Indiana, including what your options are and when it’s time to contact a car accident attorney.

What happens when you’re in an accident with an uninsured driver?

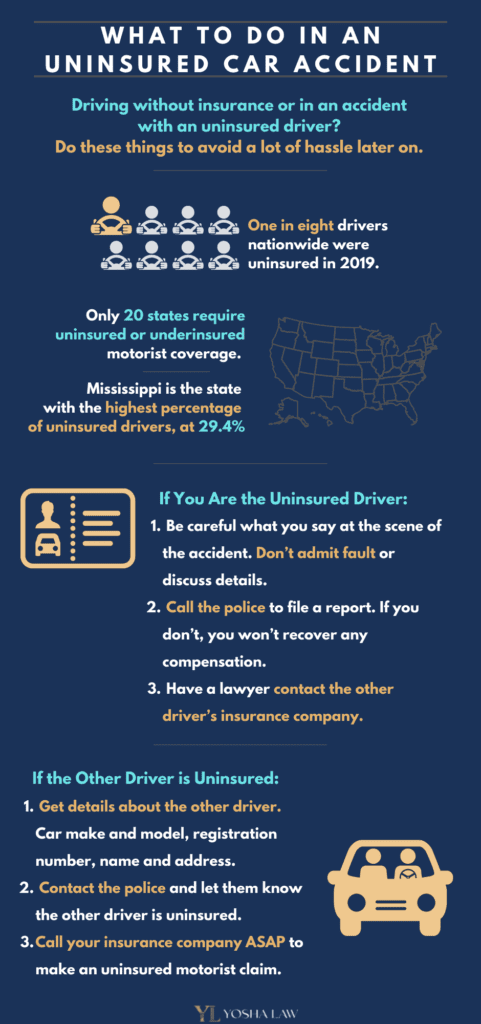

How this type of case is handled depends on the coverage you have, who was at fault in the accident, and whether the other driver is uninsured or underinsured (meaning they have insurance but not enough to compensate for your losses). Generally, you have two options when you’re in this situation:

- Claim benefits through your insurance company’s uninsured motorist coverage

- File a legal claim, like a personal injury lawsuit, against the other driver

How uninsured motorist coverage works

If you’ve been in an accident with another driver who is uninsured, one of your very first options is using your uninsured motorist coverage through your insurance company. This type of coverage is required for every auto insurance policy in Indiana, and you can only opt out of it by submitting a written request to your insurance company within the first 60 days of starting your policy.

Uninsured or underinsured motorist coverage kicks in when another driver in your accident has no coverage or not enough coverage to cover the losses you sustained in the accident. It helps bridge the difference between the other driver’s coverage and the total amount of your losses. The amount of uninsured motorist coverage can’t exceed your liability coverage. If you have $50,000 in liability coverage, for instance, your uninsured motorist coverage cannot be higher than $50,000.

If you know that the other driver does not have insurance, or suspect that they don’t, you should contact your insurance company about it right away. There is usually a very short deadline to make an uninsured motorist claim.

Will your insurance company go after an uninsured driver?

Although you may have uninsured motorist coverage, whether your insurance company will actually go after the uninsured driver depends on some other factors. To put it simply, if a driver has no insurance, your insurance company can’t make a claim against them.

But there are other ways to recover damages.

The first option is for your insurance to subrogate the claim, meaning they’ll sue the other driver. Another option, if you don’t have uninsured motorist insurance, is filing a personal injury lawsuit against the other driver. If the filling process and the subsequent actions prove to be too difficult, you can always get in touch with a professional. A good lawyer would always know how to deal with a personal injury lawsuit in Muncie, Gary, Merrillville, or anywhere in Indiana.

Your options if a defendant can’t or won’t pay damages

Let’s say your uninsured motorist insurance doesn’t provide the adequate coverage for your losses or you don’t have uninsured motorist insurance, and you decide to file a personal injury lawsuit to recover compensation. Though it’s not always the case, it’s likely that the uninsured driver in your accident does not have the assets to pay a personal injury judgment.

So is filing a lawsuit still worth it?

There are still two ways your attorney could help you recover damages from a defendant if they won’t pay a judgment:

- Lien on property: If the defendant does own some assets, your attorney can help you get a lien on that property, so the assets are frozen throughout the course of the lawsuit. After the judgment, the defendant doesn’t have to sell their property right away but when they do, you receive a portion of the proceeds from the sale.

- Payment plan: The defendant might have some money but not enough to pay the entire judgment immediately. In this case, the court can set up a payment plan so the defendant can pay you in smaller amounts on a weekly or monthly basis.

An accident with an uninsured driver: an example

In a case involving a collision between a woman who was eight months pregnant and an uninsured driver in Indiana, the woman’s insurance company wasn’t willing to help cover medical bills related to the accident. The woman went into labor early as a result of the accident, and had to have an emergency c-section after leaving the scene of the accident. However, because at the time of the accident the baby had not been born yet, the insurance company didn’t consider the baby a person yet, and therefore would not cover the medical costs associated with the child’s early birth.

She contacted the Yosha Law Firm in order to get the insurance company to cover all medical costs related to the accident, including care for her newborn daughter. The insurance company wasn’t willing to provide that coverage because the other driver, the one who t-boned the woman and forced her into an early delivery of her baby, didn’t have adequate auto insurance. In this situation, working with an attorney ended up being the best option for the woman.

How a car accident attorney can help

When it comes to seeking compensation after an accident with an uninsured driver, there are a lot of factors to consider. If you’re unfamiliar with how uninsured motorist insurance works or what your other options are, it may help to have an experienced car accident attorney in your corner.

Once you realize the other driver did not carry active car insurance at the time of the crash, remember that your insurance company is not your ally. If your insurance company can find any way to mitigate the amount rightfully owed to you under your UM claim, they will pursue it. You shouldn’t let them. After all, you paid a monthly premium for this insurance protection just in case you were ever the victim of another driver’s negligence who was also uninsured.

You should contact a personal injury attorney for a free case consultation to protect yourself from being mistreated by your insurance company. These consultations cost you nothing, but the early settlement with your insurance could cost you thousands or even hundreds of thousands.